Have you ever felt overwhelmed by data when reading through a quarterly research report?

Throughout the year, local firms publish plenty of data explaining the trends and strengths of the Triangle real estate market. To cut through the noise and deliver the most value per minute of read time, I have summarized my key takeaways from five different reports from the first quarter of 2022.

Below you will find actionable insights from Downtown Raleigh Alliance, Lee & Associates, JLL, Cushman & Wakefield, and CBRE.

If you have any questions, feel free to follow up via email at jbyrne@withersravenel.com.

Downtown Raleigh Alliance Q1 2022 Market Report

With our offices in downtown Raleigh, it is easy to see and feel the positive momentum in Raleigh. Some of my biggest takeaways from the first quarter DRA report include a solid construction pipeline, robust residential occupancy and projected growth, and substantial year-over-year upticks in food and beverage sales and pedestrian traffic.

Development Pipeline

In 1Q2022 there are $642 million in projects under construction in downtown Raleigh. This compares to $765 million completed since 2020 and an additional $3.75 billion in construction that is proposed or planned.

Residential

As of 1Q2022 average residential occupancy is 95.8 percent. This occupancy is enough to support the addition of 1,456 residential units that are currently under construction. On top of the units currently under construction, another 5,536 units are planned or proposed in downtown Raleigh.

The units currently under construction represent an additional 42 percent compared to all residential units that were built in downtown Raleigh since 2015 (3,451 units).

Average effective rents for downtown Raleigh apartments stand at $2.32 per square foot.

Parking

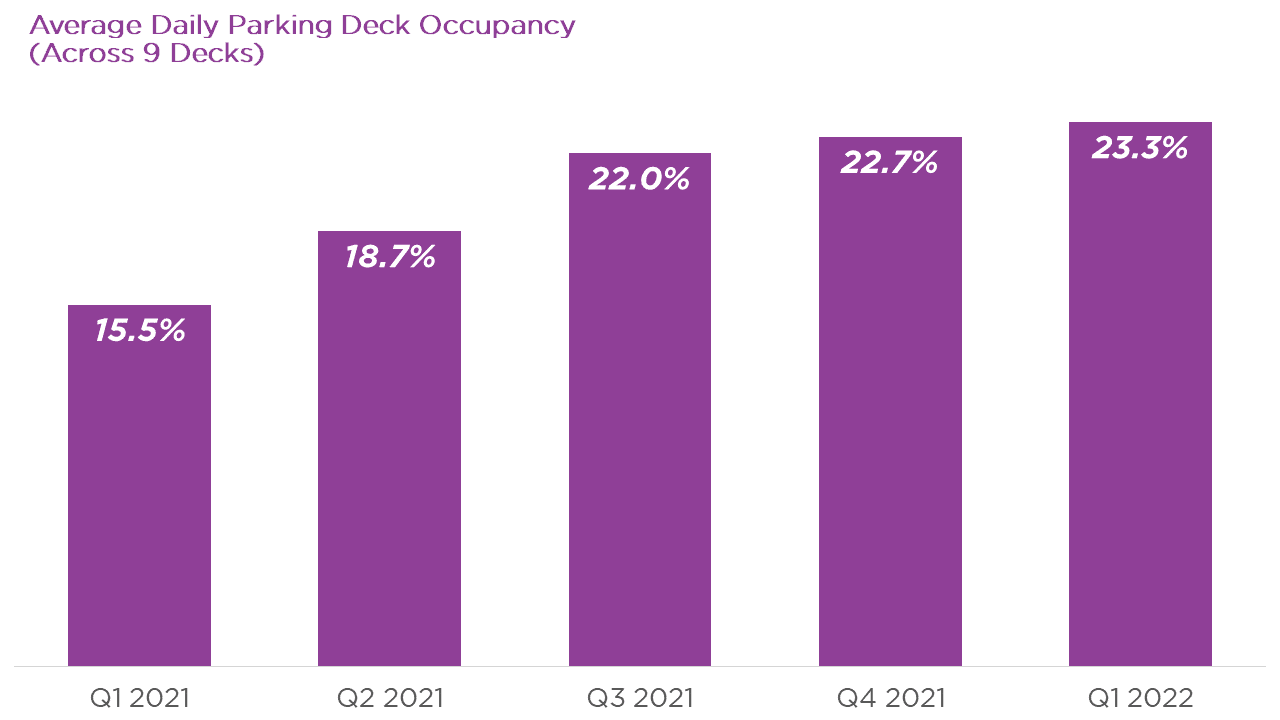

Average daily parking deck occupancy for the nine City decks is also on the rise. Compared to a 1Q2021 average occupancy of 15.5 percent, the current numbers have increased 50 percent year-over-year to 23.3 percent.

It should be noted that the data above represents average taken from a once per day sampling. The data does not measure peak occupancy. Additionally, there is no pre-pandemic data to compare the current occupancy against, so the values above are a percentage of absolute occupancy potential and note a comparison to previous long term averages.

Food and Beverage

With only 2 months of data for Q1, the food and beverage sales for downtown Raleigh came in at $19.5 million which is a 59 percent increase over a complete 1Q2021. Food and beverage sales for the last 11 months totaled $82 million compared to $35.9 million for the preceding 12 months, which is a 128 percent increase.

Pedestrian Traffic

Using six pedestrian counters across the downtown footprint, average daily pedestrian traffic increased 63 percent in 1Q2022 when compared to the same time frame in 2021.

Lee & Associates 1Q2022 Raleigh Market Overviews

As expected, the Lee & Associates research summaries show strong growth in the industrial, retail, and multifamily sectors.

Industrial

The industrial market sector continues to be one of the hottest sectors in the Triangle. In Raleigh, net absorption over the last 12 months was 2.2 million square feet, which represents 2.3 percent of the total 94-million-square-foot market.

The vacancy rate remains incredibly low at 2.3 percent, and triple net asking rates are at an all-time high of $9.88 per square foot.

The current inventory under construction represents another amazing statistic. There are 4.2M square feet of space currently under construction which is 4.48 percent of the market. This is a 47 percent increase in square footage under construction since 4Q2021. As a percentage of the market this represents a 3.35X increase year-over-year compared to the less than 1M square feet that was under construction in 1Q2021.

Retail

For the second straight quarter, absorption in the retail market has been over 1 million square feet. The overall market vacancy is down to pre-Covid levels at 2.87 percent.

On the transactions side of the business, the biggest announcement was Crabtree Valley Mall being put on the market.

Multifamily

As for-sale housing prices continue to break records across the state, the performance of the multifamily asset class remains very strong.

Multifamily vacancy has creeped up slightly to 5.88 percent leaving 6,506 units vacant across the market based on an overall inventory of 110,649. At a 1Q2022 absorption rate of 4,043 (over 12 months), if no new apartments were built, we would run out of stock in 19 months. Fortunately, the number of units under construction is also tracking up. There are currently 8,911 units under construction, an 83 percent increase over 1Q2021.

JLL Raleigh-Durham Office Insight Q1 2022

For the Raleigh-Durham market, JLL is predicting strong momentum into the rest of 2022.

For the first time in market history, average asking rents across the market surpassed $30 with an overall asking rent of $30.21 per square foot. This rent growth represents 4.1 percent average year-over-year increases for the last 5 years.

Sublease asking rents trail behind at $25.22 per square foot across the market. This discount compared to direct rents is a change from 2019, when sublease rates were at a premium to direct rents.

Deliveries in the market are slowing down, which should prop up absorption. Over the last two quarters, 1.3 million square feet were delivered compared to the projected 200,000 square feet in 2Q2022.

When comparing urban and suburban products, we see the following differences (all prices are dollars per square foot):

- Overall urban rents are at $35.26 and suburban rents are at $29.34, resulting in a market average of $30.21.

- Class-A urban rents are at $37.21 and suburban rents are at $31.17, resulting in a market average of $32.02.

- Class-B urban rents are at $30.52 and suburban rents are at $23.73, resulting in a market average of $24.88.

- Interestingly, Class-B rents in downtown Durham exceed Class-A rents, $31.56 to $30.43, respectively.

Cushman & Wakefield Marketbeat Raleigh-Durham Office Q1 2022

Continued tailwinds in employment statistics in the Triangle should lead to better relative performance in our office market compared to the rest of the country.

In 1Q2022 local unemployment dropped to 3.2 percent compared to a market high of 12.2 percent in May 2020. US unemployment is at 3.6 percent. Non-farm employment added 48,300 jobs year-over-year. This quarter Vinfast, the largest economic development deal in state history, announced $6.5 billion in investment and 13,000 jobs.

Multiple large blocks of space came on the sublease market, causing a 33 percent increase in sublease availability quarter-over-quarter, from 3 percent of market stock to 4 percent. As an example, GSK moved from their 500,000-square-foot campus to occupy 70,000 square feet in downtown Durham.

As a submarket, Class-A space in CBD Durham is topping the market at $41.95psf with CBD Raleigh trailing at $36.93psf. However, North Hills office bests both at $42.18psf.

CBRE Office Report 1Q2022

While office vacancy rates continue to rise from a low in 1Q2020, so do rental rates.

CBRE tracks 59 million square feet of office product in Raleigh. Current sublease inventory clocks in at 3.1 million square feet, or 5.2 percent of overall inventory. Construction activity clocks in at 2.2 million square feet, or 3.7 percent of inventory.

Downtown Raleigh experienced the greatest absorption of any submarket at 72,900 square feet, while RTP/I-40 experienced the lowest absorption at -155,000 square feet.

In the sublease market, five major sublease blocks account for 34 percent of the space. IBM (178,000 square feet), Duke Health (126,000 square feet), IQVIA (106,000 square feet), Glaxo Smith Kline (485,000 square feet), and Duke Energy (170,900 square feet) total to 1.1 million square feet of the 3.1 million square feet of sublease space available.

Conclusion

Except for the office asset class, the trends in the Triangle market are overwhelmingly positive. The macroeconomic trends pushing growth in our region should continue to benefit developers and owners for some time.

If you have any questions about the information above, please reach out via email at jbyrne@withersravenel.com.