The CBRE Insights & Research Department recently released a 2022 Outlook Report covering major trends across the US. To summarize the 40-page report, I have included my top six topics of interest below, along with a key takeaway for each.

If you have any follow up questions or would like to discuss any of these topics with me, shoot me an email at jbyrne@withersravenel.com.

Additionally, if you are interested in further exploring these topics, you will find links to the report as well as an episode of CBRE’s podcast The Weekly Take discussing the trends at the bottom of the article.

Now, onto the first key topic.

1. Inflation

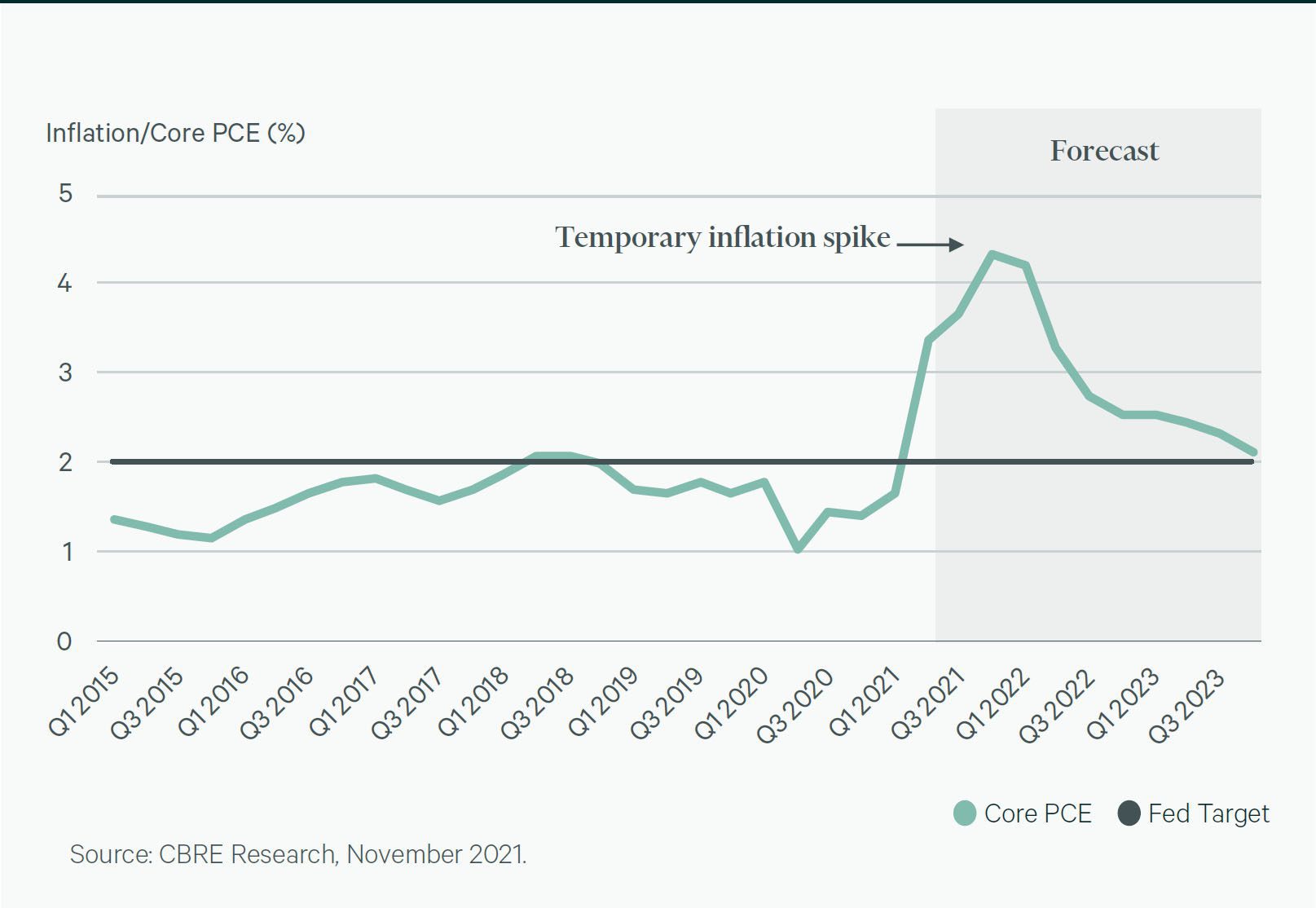

Inflation which has a direct impact on the supply on goods and services reached a high point in 2021. Inflation impacts WithersRavenel along with all of our clients. Looking at the data and forecast from CBRE, you will see a peak in inflation in 2021 followed by an expected downward trend for the following year. By the end of 2023, CBRE anticipates that inflation will be back down to the long-term target rate of 2%.

Key Takeaway: Inflation looks to have peaked in 2021 and will return to normal by 2024.

Inflation vs. Fed Target, CBRE House View

Source, used with permission

2. Total Investment Volume

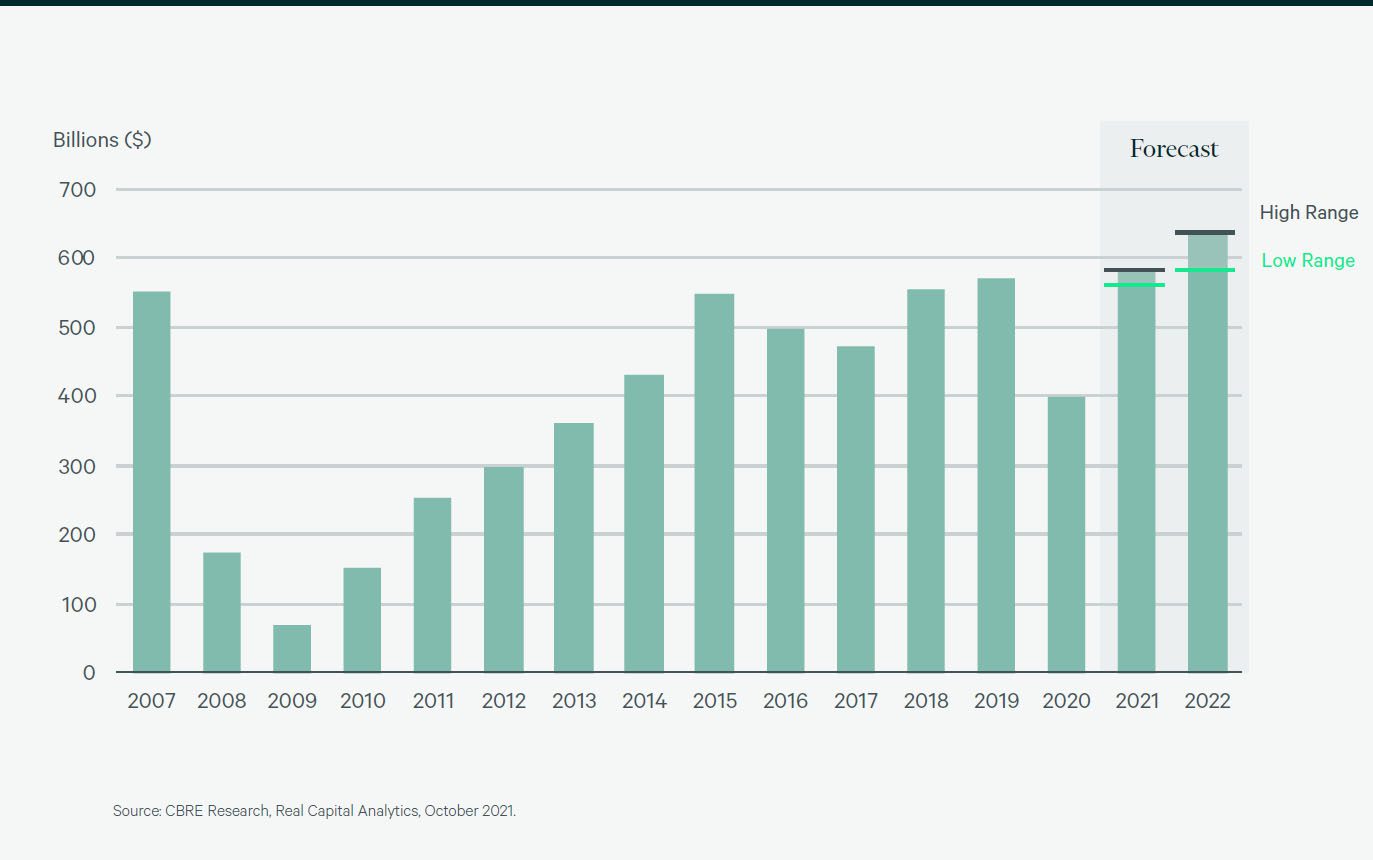

Capital markets trends are looking strong after a significant drop in national deal volume in 2020. Deal volume across all asset classes in the US is forecast to return to pre-pandemic levels in 2021 and in 2022 is projected to beat 2021 by 5-10%. A large amount of equity capital seeking investment in the real estate sector, as well as a healthy supply of low-cost debt, is driving this rebound.

This surge in investment activity is seen locally in the $330M sale of the first two towers at Block 83.

Key Takeaway: More certainty about the future added to pent-up demand for transactions along with a large supply of capital results in a revival in deal flow in 2021 and 2022.

Total U.S. Capital Investment Volume

Source, used with permission

3. Overall Cap Rate Compression

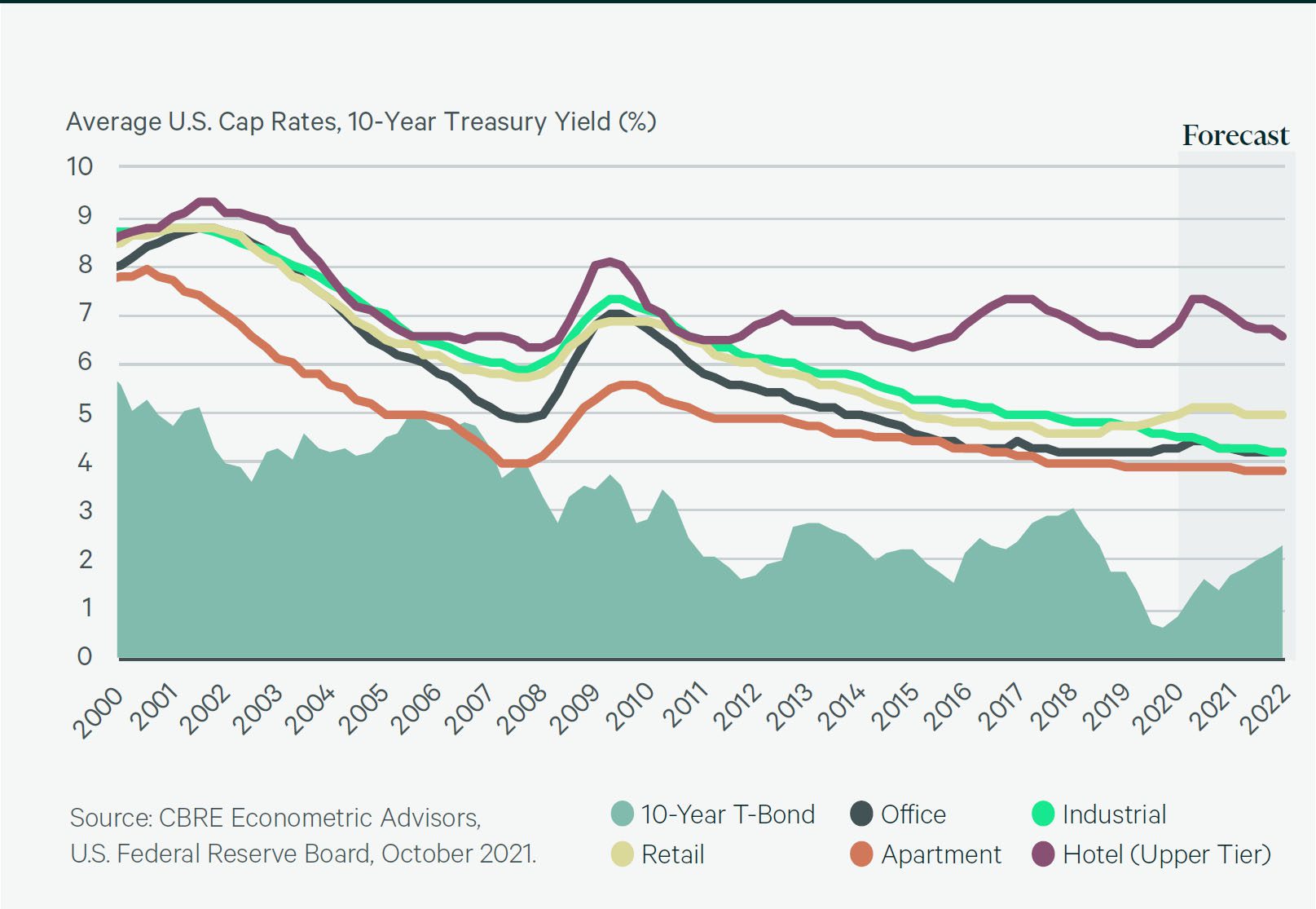

In the chart below you can see Cap Rates (Net Operating Income divided by Purchase Price) will remain steady and historically low in 2022.

Apartments lead the way with overall cap rates below 4%, followed by office and industrial, and trailed by retail.

The major outlier on the chart is hotel. While remaining steady and even decreasing, the hotel trend seems to float above the crowd. The hotel trend line separated from the pack in 2011.

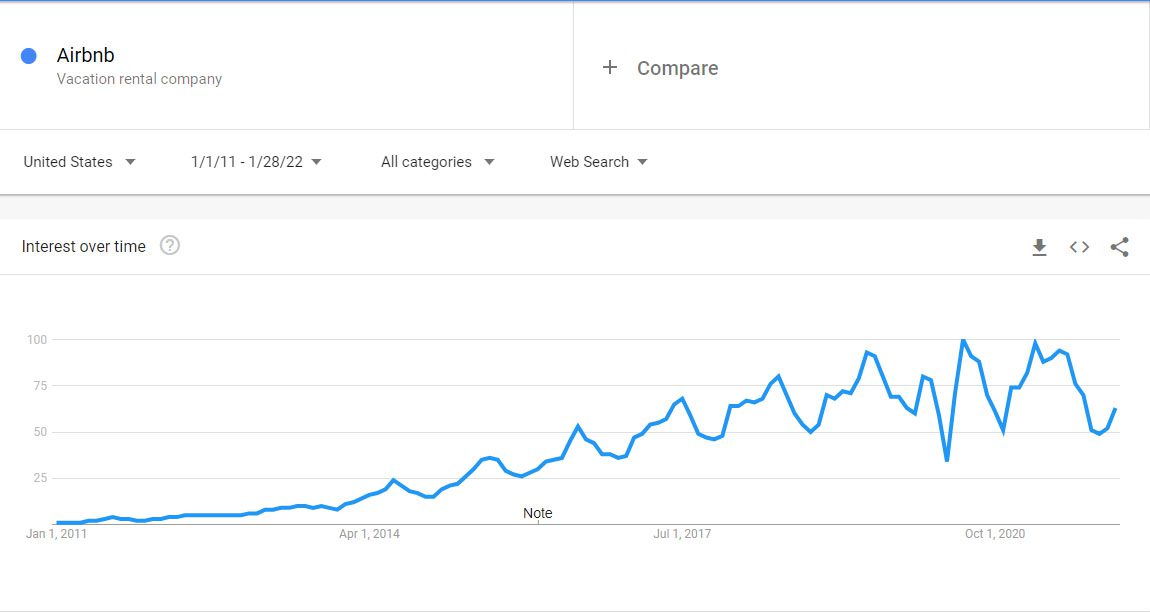

Looking at Google Trends in the chart below, I find it interesting that search results for Airbnbstarted growing in 2011. I can’t say for certain that the popularity of Airbnb impacts the value of hotels, but it is an interesting coincidence.

Key Takeaway: Cap rates for all asset classes remain stable and lower than historical average, but hotel remains elevated above the pack as it has been for the last 11 years.

Spread Over Risk-Free Rate Narrowing but Still Significant

Source, used with permission

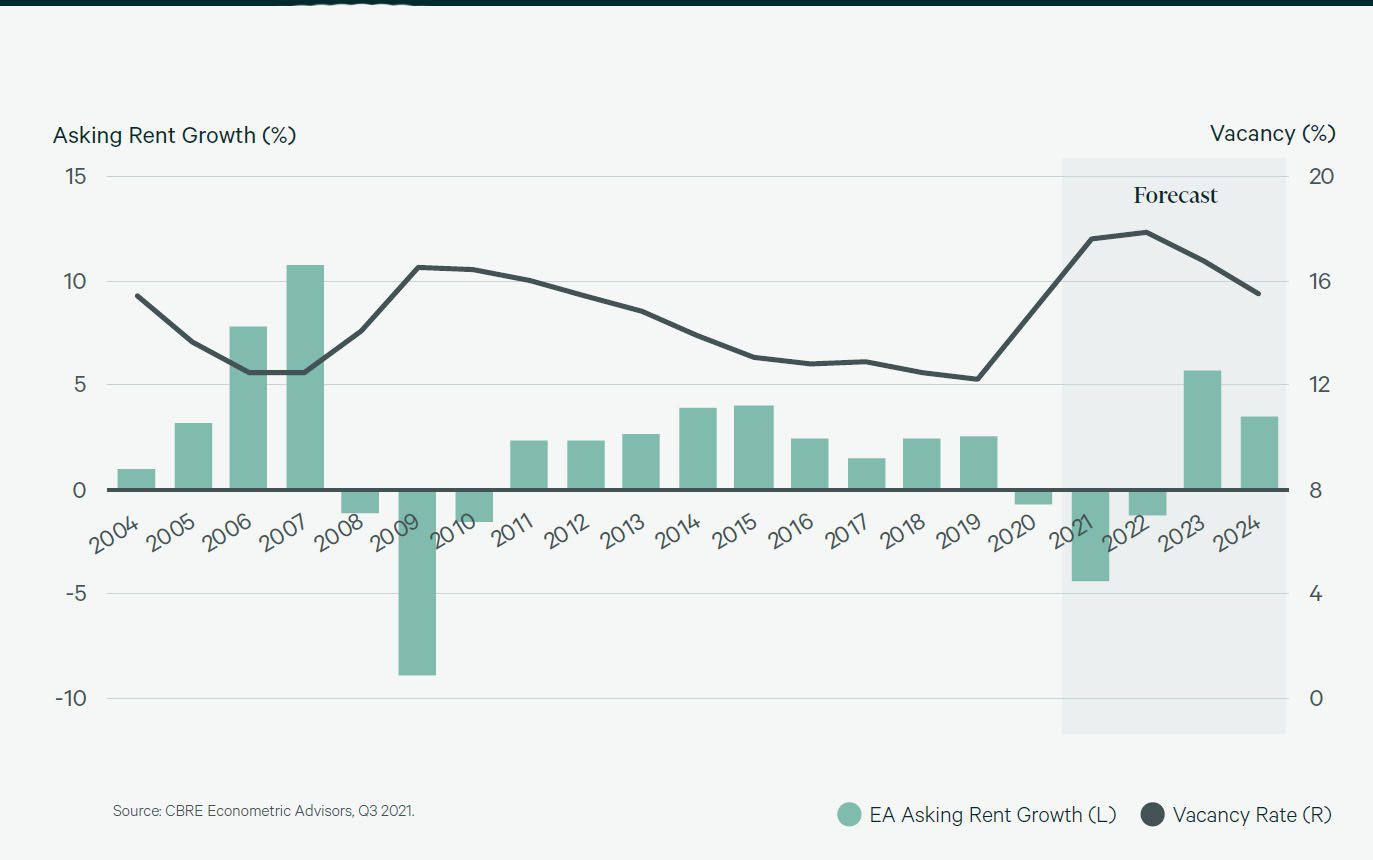

4. Office Vacancy

In 2021, the number of new office lease transactions increased over 2020, but the level of transaction volume is still depressed. Net absorption has been negative since 1Q2020. In fact, CBRE is projecting that net absorption of office space won’t return to positive territory until sometime in 2022.

What is net absorption?

Positive net absorption means that more space is leased and moved into than is moved out of or demolished. Positive net absorption means the market is growing.

Looking at the chart below you can also see that office vacancy is forecast to peak in 2022.

Key Takeaway: Office space use is still lagging the rest of the market due to the increase in flexible and hybrid work, but net absorption should cross into positive territory this year.

U.S. Office Rent and Vacancy Forecast

Source, used with permission

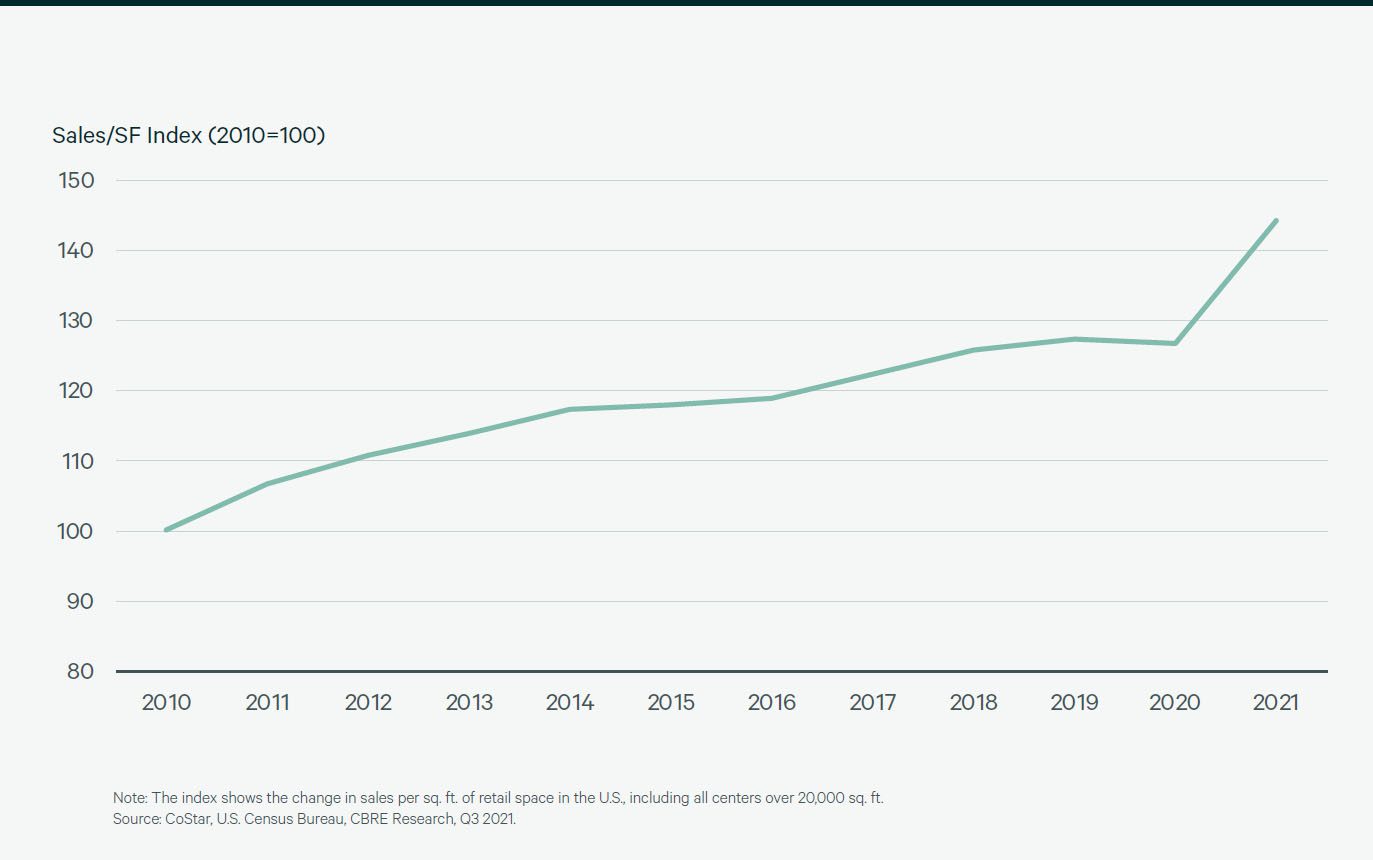

5. Retail Sales

Despite the struggles faced by retail operators throughout the pandemic, the CBRE research shows an incredible uptick in retail space efficiency. Efficiency is a measure of retail sales per square foot of space. As you can see in the chart below, while retail sales/sf have increased since 2010, 2021 shows the sharpest increase in year-over-year efficiency in the last 12 years.

Given that several retailers closed a large number of stores in the last two years, it is unclear to me how much of the increase in efficiency is due to elevated sales and how much is due to smaller footprints.

Key Takeaway: For retailers that are making it through the pandemic struggles, sales per square foot numbers are experiencing tremendous growth.

Ratio of U.S. Retail Sales to Retail Sq. Ft.

Source, used with permission

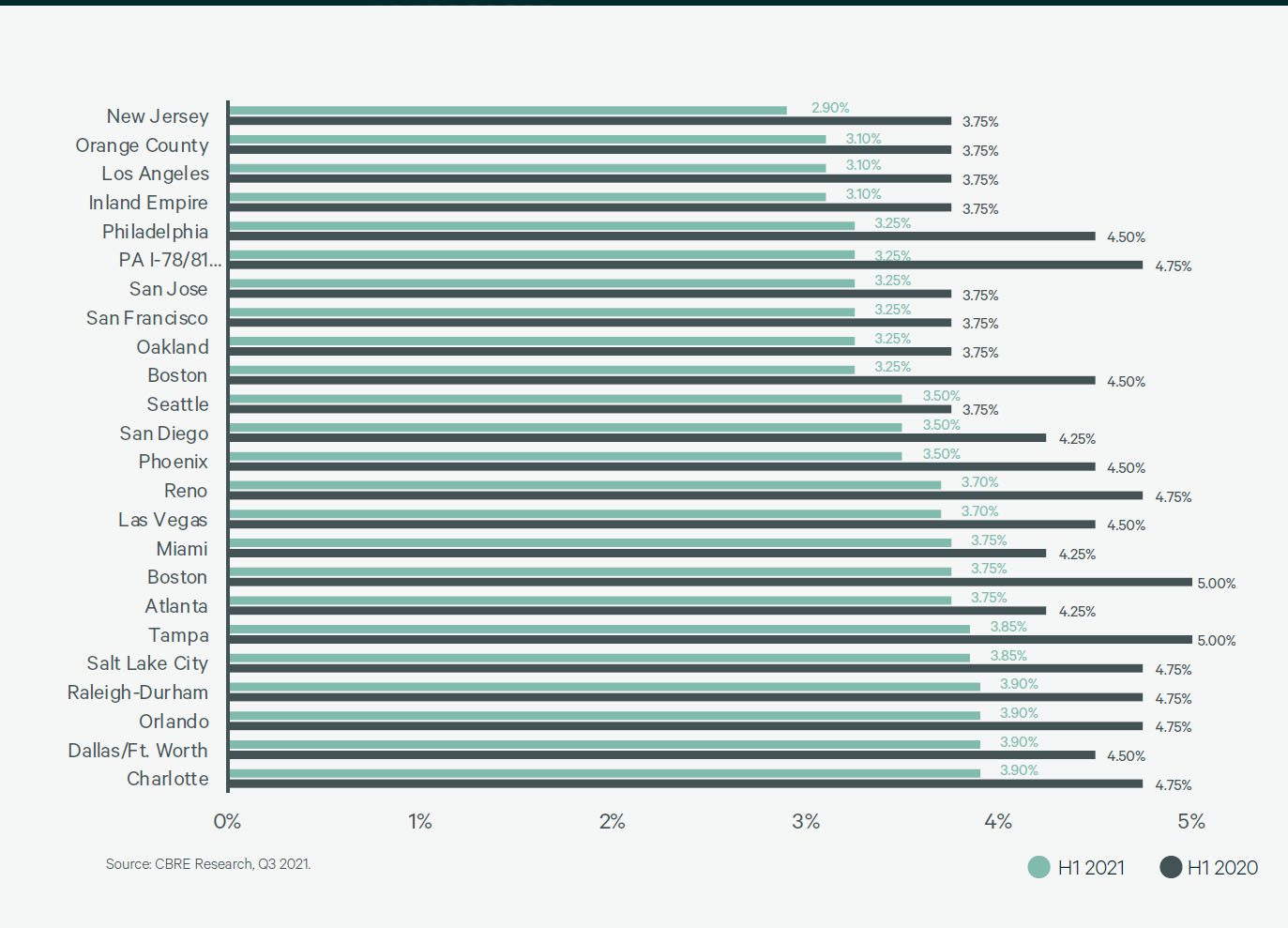

6. Industrial

Industrial development, supply chain issues, and logistics have been hot topics throughout the pandemic. A spike in e-commerce coupled with supply chain hiccups have pushed demand for warehouse space to all-time highs. As demand increases, pricing rises. As shown in the chart below, between 1H2020 and 1H2021 cap rates decreased substantially (prices increased) in many major markets.

Prices for warehouse buildings in the Triangle have never been higher, as indicated by the cap rates hovering just below 4%. The big surprise to me from the data is not that our cap rates are low, it’s how low cap rates have gone in some other markets. In New Jersey, the 1H2021 cap rates are at 2.9%, which is 25.6% lower than Raleigh.

Key Takeaway: Industrial pricing has never been higher in Raleigh, and there is more room to grow as pricing pushes up higher in other markets and supply shifts to secondary markets.

Cap Rate Compression Continues for Industrial Assets

Source, used with permission

Conclusion

Whether a trend is positive or negative, North Carolina and the Triangle seem to fair better than average. People and businesses continue to flock to the state, and investors are seeking higher relative returns in our markets.

I hope these trends have been informative. As mentioned before, if you have any questions, email me at jbyrne@withersravenel.com. If you’d like to further dig into the report, check out the report website and CBRE’s podcast.